Coronavirus and the Impact on Markets

March 9, 2020

In the past week or so, we’ve seen share markets fall on the back of growing concerns about the spread of the coronavirus. At times of heightened market volatility, it’s easy to fear how your superannuation and other investments might be affected, but it’s important to understand the nature of market movements before making any sudden decisions.

Since the coronavirus was first detected at the end of 2019 in the Hubei province of mainland China, the world has cautiously watched the situation as the virus spread to neighbouring nations in Asia and then further abroad. Governments around the world have responded in various ways to try and contain the spread of the virus, including quarantines on returning international travellers and restrictions on travel to certain countries like China and Iran.

As at Tuesday, 3 March 2020, there were 33 confirmed cases of coronavirus in Australia, with the first confirmed death sadly recorded earlier in the week.1

Impact on markets

Following an initial correction in early February that the market recovered from, evidence that the incubation period is longer than first understood, coupled with a sharp increase in the number of confirmed infections outside China, gave rise to concern about failure to contain the spread of the coronavirus, which in turn caused extreme market volatility.

US shares fell sharply in the past week, with the S&P recording its biggest weekly fall since the 2008 Global Financial Crisis (GFC). This also marked the fastest ever retreat from an all-time high, recorded earlier in February. As more cases surfaced globally, there was an increased expectation of significant impact to global growth in the short-term at least, which led to the falls we’ve seen.

Outside the US, the Australian market felt the brunt as well, with shares falling 12%. China and Japan also saw falls in a similar range, while Europe dropped 16% as well. The main reason for these shocks is because of the market’s reassessment of the risk of a global pandemic and the resulting impact on global growth. Investors also feared that trade, particularly with China, would be further restricted. China is the world’s largest exporter of goods, and Australia’s number one trade partner.2

On Tuesday, 3 March we saw the ASX rebound as shares rallied – an indication that the market continues to react in extreme fashion to both positive and negative news.

Falls are normal, even without fear of coronavirus

We’ve seen share market corrections occur frequently, sometimes as high as 15%. Last year, we saw a 7% fall in August alone in Australia. What’s compounding the issue at the moment is the emotional aspect, as people are concerned about the broader health implications, particularly for the elderly or those susceptible to respiratory conditions.

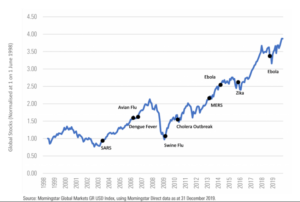

Over time though, we’ve seen that markets are resilient against global epidemics. Even if the immediate impacts cause a temporary fall, the long-term trend is positive:

Source: Morningstar Global Markets GR USD Index, using Morningstar Direct data as at 31 December 2019

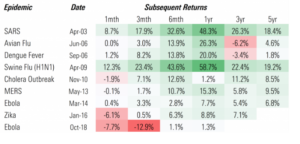

The chart below also shows how markets can rebound following some of the major epidemics in recent history:

Source: Morningstar – Coronavirus: An investment perspective

Important considerations

We understand that investors become anxious when superannuation and shares are so heavily impacted in a short space of time. It’s important to remember that these are long term investments which can fluctuate but historically produce strong returns. Even after significant events such as the GFC, there is evidence the long-term trends are positive for investors who stayed the course and took advantage of the potential market upswing:

Source: Morningstar: How to become an emotionally intelligent investor

At the moment, any falls you may have seen are technically only a ‘loss on paper’. However, when the market recovers there’s a chance your investments could return to their pre-fall state. Selling at the ‘bottom of the market’ only serves to crystallise these losses, making them real and irreversible.

How we can help

Your financial plan was designed for you to suit your investment objectives and risk profile. Please feel free to contact us if you have any concerns or questions about the recent volatility we’ve seen in the market and we’ll be happy to assist.

Speak to us for more informationSpeak to us if you would like to understand more about how this information may impact your financial situation. |

1 https://www.health.gov.au/news/health-alerts/novel-coronavirus-2019-ncov-health-alert

2 https://www.dfat.gov.au/trade/resources/trade-at-a-glance/Documents/index.html

This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial adviser, whether this information is appropriate in light of your investment needs, objectives and financial situation. Any opinions expressed in this material are opinions only and are subject to change without notice. Such opinions are not a recommendation to hold, purchase or sell a particular financial product and may not include all of the information needed to make an investment decision in relation to such a financial product. No liability is accepted for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that Count believes to be accurate and reliable, however Count offers no warranty that it contains no factual errors.

Count Financial Limited ABN 19 001 974 625, AFSL 227232 (Count). Count is 85% owned by CountPlus Limited ACN 126 990 832 (CountPlus) of Level 8, 1 Chifley Square, Sydney 2000 NSW and 15% owned by Count Member Firm Pty Ltd ACN 633 983 490 of Level 8, 1 Chifley Square, Sydney 2000 NSW. CountPlus is listed on the Australian Stock Exchange. Count Member Firm Pty Ltd is owned by Count Member Firm DT Pty Ltd ACN 633 956 073 which holds the assets under a discretionary trust for certain beneficiaries including potentially some corporate authorised representatives of Count Financial Ltd. ‘Count Wealth Accountants’ is a business name of Count. Count advisers are authorised representatives of Count. While care has been taken in the preparation of this market update, no liability is accepted by Count, its related entities, agents and employees for any loss arising from reliance on this market update.