Important Update: New TPB Code of Professional Conduct Obligations Effective 1 July 2025

June 26, 2025

From 1 July 2025, significant updates to the Tax Practitioners Board (TPB) Code of Professional Conduct will come into effect for tax practitioners with 100 or fewer employees. These changes are part of the Tax Agent Services (Code of Professional...

Read more

Division 296 Tax: What You Need to Know (and Why We Should Wait)

May 28, 2025

As part of the Federal Government’s recent superannuation reform agenda, a new measure called Division 296—has been introduced to impose an additional tax on individuals with superannuation balances exceeding $3 million. This has generated a fair amount of discussion (and...

Read more

Embracing change: We are upgrading our practice management and e-signature software

July 28, 2023

At Apiary Financial, we always strive to provide our clients with the best possible service. We believe that innovation is key to staying ahead in today's fast-paced business environment. With this in mind, we are excited to announce a significant...

Read more

Is your business ready for Single Touch Payroll Phase 2?

December 20, 2022

Single Touch Payroll Phase 2 (STP2) reporting became mandatory on 1 January 2022. While a number of Digital Service Providers (DSP) such as Xero and QuickBooks Online obtained STP2 deferrals, these will be expiring shortly, meaning employers will soon need...

Read more

Important Director ID Update, Resigned Directors Required To Register

November 4, 2022

The 30 November 2022 deadline for Directors IDs is quickly approaching. Our previous articles have detailed the requirements for the Directors ID, however the ATO has recently confirmed that directors who were appointed as Directors on or before 31 October 2021 are also required...

Read more

Director ID required by 30 November 2022

October 20, 2022

Just a reminder that if you were a director of a company on 31 October 2021, you need to obtain a Director ID by no later than 30 November 2022. You can apply online or over the phone. https://www.abrs.gov.au/director-identification-number/apply-director-identification-number To...

Read more

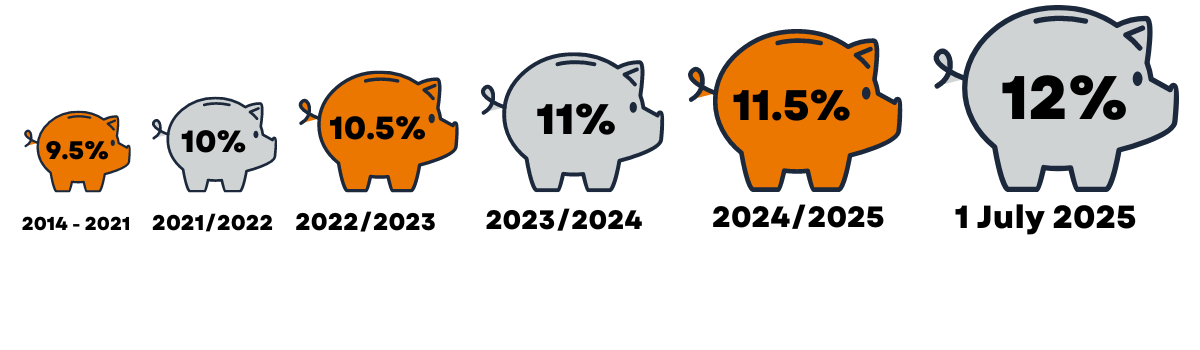

Are You Ready for the Super Changes

October 18, 2022

We would like to remind you to ensure you update your payroll and accounting systems so that you continue to pay the right amount of super for your employees. There are two important super guarantee (SG) changes that came into...

Read more

Director Identification Number requirements

July 29, 2022

In November 2021, a new initiative was introduced that requires all directors of companies in Australia to obtain a director identification number (director ID). A director ID is a 15-digit unique identifier that remains with you forever, regardless of whether...

Read more

Have you considered the need for tax audit insurance?

As the new financial year kicks into gear, it’s important to set yourself up for success by putting measures in place to protect your business and personal interests. Ongoing developments in data-matching technology have allowed the ATO to increase the...

Read more