Get ready for changes to super guarantee

June 9, 2022

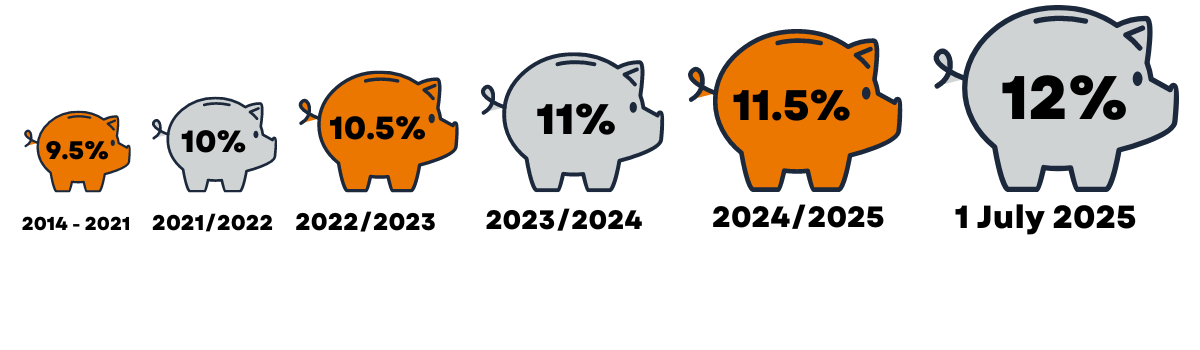

From 1 July 2022 there are two important changes to super guarantee (SG) that will apply to your business. These are: the rate of SG is increasing from 10% to 10.5% the $450 per month eligibility threshold for when SG...

Read more

Further changes to Superannuation Rules and extension of Temporary Full Expensing of Depreciating Assets

March 1, 2022

A Bill that implements a number of changes to superannuation as proposed in the 2021-22 Federal Budget and extends the temporary full expensing of assets by a further 12 months to 30 June 2023 has now passed both houses of...

Read more

What to expect in Phase 2 of Single Touch Payroll

November 17, 2021

In 2022, Phase 2 of Single Touch Payroll (STP) will come into effect. This expansion of STP is intended to reduce reporting burdens for employers who need to report information about their employees to multiple government agencies, as well as...

Read more

New director identification requirements apply from 1 November 2021

November 8, 2021

From November 2021, directors of a company in Australia will need to verify their identity and apply for a director identification number (DIN) via the Australian Business Registry Services (ABRS) website. A DIN is a unique 15-digit identifier that, once...

Read more

As Data Matching advances, Tax Audit Insurance is more important than ever

September 1, 2021

As the new financial year kicks into gear, it’s important to set yourself up for success by putting measures in place to protect your business and personal interests. In recent years, developments in data-matching technology have allowed the ATO to...

Read more

2021 COVID-19 Business Support Grants Available

August 20, 2021

The Queensland Government has released a grant program to support eligible Queensland businesses that have been directly and indirectly affected by the August 2021 COVID-19 lockdowns. The program is designed to support employing small and medium sized businesses and not...

Read more

Changes to SuperStream on 1 October

August 2, 2021

On 1 October, the ATO will implement changes to SuperStream obligations. In this post, we outline what SuperStream is, how the ATO standards for implementation could affect you and how you can make sure you’re SuperStream compliant. What is SuperStream?...

Read more

Are you ready for the July 1 changes to superannuation?

June 23, 2021

From 1 July 2021, a number of changes to superannuation will take effect. The compulsory superannuation guarantee (SG) rate will rise for the first time since 2014, the maximum amount of SG an employer is required to pay based on...

Read more

Strategic Planning – Pre 30 June

May 25, 2021

As we are fast approaching the end of the financial year, it is important to consider what eligible tax planning initiatives may be available to you or your business. There are a number of tax planning initiatives available to assist...

Read more

Working from home – FBT obligations for employers

April 9, 2021

As employee working from home arrangements have become common-place, it is important for employers who provide benefits and support to their employees, to understand their tax obligations including the application of fringe benefits tax. As an employer, your fringe benefits...

Read more